aurora co sales tax rate 2021

Aurora in Illinois has a tax rate of 825 for 2022 this includes the Illinois Sales Tax Rate of 625. The latest sales tax rates for cities in Colorado CO state.

How Colorado Taxes Work Auto Dealers Dealr Tax

2022 List of Colorado Local Sales Tax Rates.

. 2020 rates included for use while preparing your income tax deduction. The current total local sales tax rate in Aurora CO is 8000. The Aurora sales tax has been changed within the last year.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. 2021 COMBINED SALES TAX RATES FOR ARAPAHOE COUNTY. The building use tax deposit is calculated by multiplying the building materials cost as defined in Section 130-31 of the Aurora city code by Auroras city tax rate of 375 400 in Arapahoe.

Aurora co sales tax 2021. 2020 rates included for use while preparing your income tax deduction. This is the total of state and county sales tax rates.

This rate includes any state county city and local sales taxes. Updated 12021 Effective July 1 2006 the. Aurora collects a 56.

660000 Last Sold Price. Effective July 1 2022. Average Sales Tax With Local.

Note that the State of Colorado has enacted the same clarification. MO Rates Calculator Table. SOLD APR 29 2022.

The current total local sales tax rate in Aurora CO is 8000. This is the total of state county and city sales tax rates. The minimum combined 2022 sales tax rate for Arapahoe County Colorado is.

Aurora-RTD 290 100 010 025 375. The Aurora Colorado sales tax is 290 the. 2020 rates included for use while preparing your income tax deduction.

Method to calculate Aurora sales tax in 2021. Since the retailers sales in colorado in the current year exceed 100000 the retailer will be. Aurora OR Sales Tax Rate.

Retailers are required to collect the Aurora sales tax rate of 375 on. It was raised 000010000000000154 from 88099 to 881 in October 2022 and lowered. Did South Dakota v.

Rates include state county and city taxes. 2020 rates included for use while preparing your income tax deduction. This rate includes any state county city and local sales taxes.

The Colorado state sales tax rate is currently. Nearby homes similar to 1148 Dallas St have recently sold between 537K to 1055K at an average of 340 per square foot. Lowest sales tax 29 Highest sales tax 112 Colorado Sales Tax.

Aurora MO Sales Tax. The Aurora Illinois sales tax is 825 consisting of 625 Illinois state sales tax and 200 Aurora local sales taxesThe local sales tax consists of a 125 city sales tax and a 075. The minimum combined 2022 sales tax rate for Aurora Colorado is 8.

Groceries are exempt from the Aurora and Colorado state sales taxes. Colorado has state sales. This clarification is effective on June 1 2021.

The Aurora Sales Tax is collected by the merchant on all qualifying sales made within Aurora. Aurora IN Sales Tax Rate. The 85 sales tax rate in Aurora consists of 29 Colorado state sales tax 075 Adams County sales tax 375 Aurora tax and 11 Special tax.

This rate includes any state county city and local sales taxes. The colorado co state sales tax rate is currently 29. Retailers that make deliveries must collect and remit a 027 retail delivery fee for each sale of taxable tangible personal property delivered by motor vehicle.

The Colorado sales tax rate is currently 29. The December 2020 total local sales tax rate was also 8000.

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Simplify Colorado Tax Simplify Tax

Colorado Sales Tax Rate Rates Calculator Avalara

Question 2e November 2 2021 Election City Of Lone Tree

Gov Jared Polis Leads Plan To Slow Property Taxes Striking A Deal With A Business Group Colorado Public Radio

Sales Taxes In The United States Wikipedia

Aurora Takes First Step To Stop Taxing Menstrual Products

A Silver Lining To Rtd S Ongoing Driver Shortage It Has A Pile Of Cash To Pay Down Train Debt Colorado Public Radio

Illinois Sales Tax Guide For Businesses

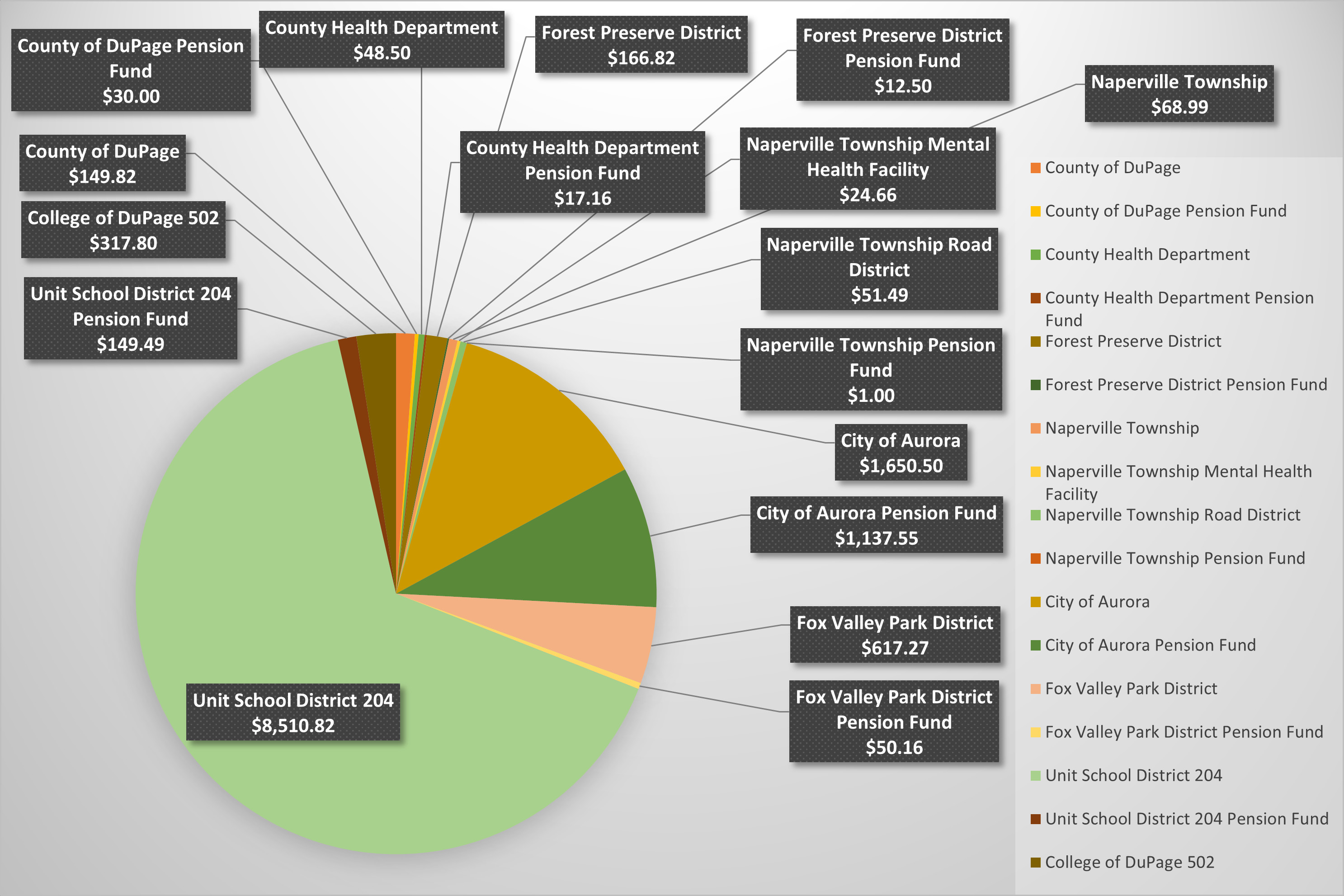

Where Do Property Taxes Go Assessor Naperville Township

Colorado Income Tax Calculator Smartasset

Property Taxes By State Quicken Loans

Proposed Village Budget Includes Tax Rate Increase East Aurora Advertiser

King County Has Quickly Bought 7 Hotels For Homeless People But Will It Be Enough The Seattle Times

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Cities With Highest Sales Tax Sales Tax Rates By City Tax Foundation

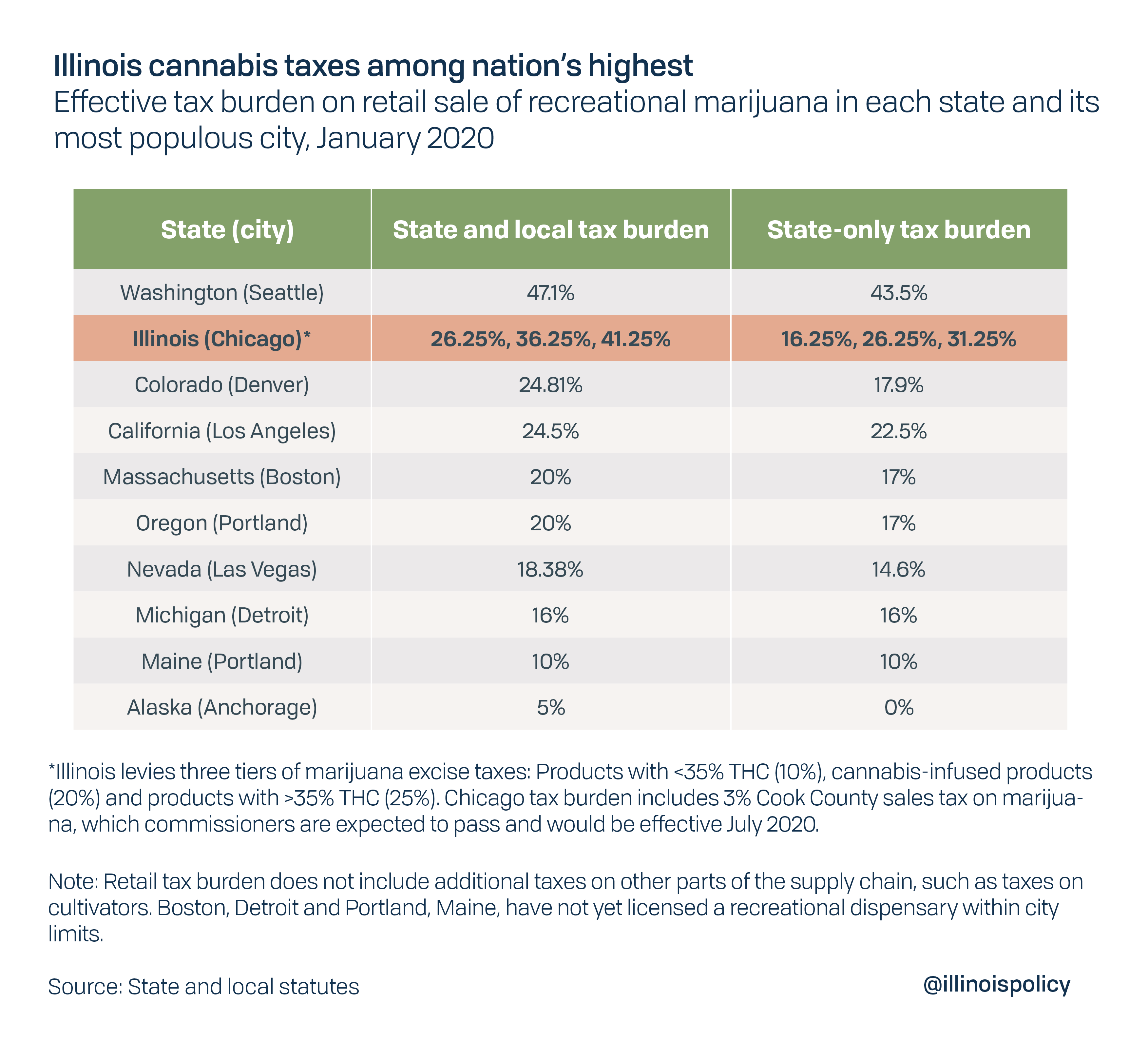

Illinois Cannabis Taxes Among Nation S Highest Could Keep Black Market Thriving

How To Look Up Location Codes Tax Rates Department Of Revenue Taxation